- Bottom of the Ninth

- Posts

- 🎾 The (Hidden) Economy Behind the Most Iconic Drink in Sports

🎾 The (Hidden) Economy Behind the Most Iconic Drink in Sports

Plus, how an 1886 barn could cost the Cubs millions.

Happy Friday!

I’m in the Big Apple this weekend for an all-time NYC sports weekend; Yankees-Red Sox and the U.S. Open (shoutout TickPick).

I’m not sure what I’m more excited for, seeing Yankee Stadium for the first time or trying a Honey Deuce. Luckily, I don’t have to pick just one.

In today’s newsletter:

🗞 The Big Story: The (Hidden) Economy Behind the Most Iconic Drink in Sports

📉 Biggest Loser: How a Barn From 1886 Could Cost the Cubs Millions

🏆 Winner’s Circle: Meet the Walk-On Linebacker Who Built Nike’s Biggest Competitor with $17,000

Learn from this investor’s $100m mistake

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from the same VCs behind Uber, Venmo, and eBay. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

🗞 The Big Story

This is the most valuable drink in all of sports, but not for the reason you might think.

The Honey Duece: Even though the U.S. Open has been held in New York City since 1978, it wasn’t until 2005 that a restaurant owner named Nick Mautone was tasked with creating a cocktail that could be served in large quantities during the tournament.

And one night, while he was scooping out balls of honeydew melon for a dessert, he came up with the idea for the Honey Deuce:

3 ounces of homemade lemonade

1 ½ ounces of vodka

½ ounce of raspberry liqueur

3x honeydew melon balls

This recipe made it easy for tournament staff to make hundreds of thousands of these drinks every year, but what no one could have expected was just how popular they would become.

In just the last seven years, sales of the now iconic drink have more than doubled from 201,000 in 2017 to over 556,000 last year.

For reference, that means more than one Honey Deuce was sold for every two people who attended the U.S. Open in 2024. The drink’s rise in popularity has even resulted in the tournament selling Honey Deuce merchandise, which you’ll see all over the tournament grounds.

But that’s not even the craziest part.

Price Increase: Because in 2012, one Honey Deuce would have cost you just $14; however, this year, that same drink now costs $23, a 64% increase, even though inflation has only risen by 37% during that same time frame.

Updated Honey Deuce price tracker for #USOpen2024, from @LevAkabas 👇

— Sportico (@Sportico)

4:08 PM • Aug 26, 2024

And based on current projections, at $23 per drink, the U.S. Open is set to make over $14.3 million from the Honey Deuce alone this year, which is enough to cover the prize winnings for both the male and female champions.

Let’s hope it tastes as good as it looks!

📉 Biggest Loser

The Chicago Cubs might be about to lose millions of dollars every year because of a barn from 1886. Let’s break it down.

Wrigley Rooftops: Last week, I explained the value of one rooftop behind Wrigley Field, which claims to be the last home around Wrigley Field not to be bought out by the Ricketts family. If you recall, the Cubs recently got special approval from the city to start putting advertising on the rooftops that they own, which has undoubtedly helped them generate millions of extra dollars in revenue every year.

The only issue is, if they don’t own all of the buildings, then there’s nothing stopping a bitter homeowner from putting up their own signs from a competing brand, essentially devaluing the Cubs’ advertising real estate.

Coca-Cola sign on a rooftop behind Wrigley Field

Which is why, for the last two years, the Cubs have been suing Wrigley View Rooftop, claiming that it’s illegal for them to sell seats to watch Cubs games from a building outside of Wrigley Field. However, a Michigan Supreme Court decision from 1886 might prove otherwise.

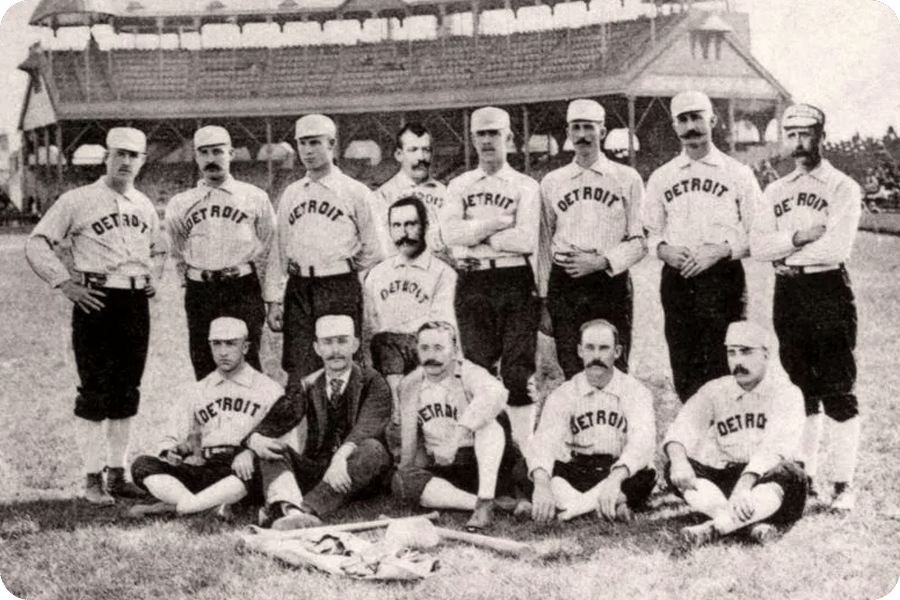

Legal Precedent: In the 1880s, a man named John Deppert Jr. owned a barn next to Recreation Park, where the Detroit Wolverines of the National Base Ball League played.

Detroit Wolverines Base Ball Team (1886)

In order to maximize ticket revenue, the team built a nine-foot-tall fence “to protect itself in the rightful use and enjoyment of the property,” but since Deppert’s barn was taller than the fence, he built seats on top of it and started selling about 100 tickets per game for less than the team was charging.

Thrown Own: The Wolverines claimed that by doing this, Deppert was stealing their profits; however, when the case reached the Michigan Supreme Court in 1886, the justices threw it out, stating that the team “lacked a legal right to use or control the use of an adjoining property it didn’t own.”

Now, the Cubs will claim that there have been other cases since that prove their point, but as one Justice wrote over 100 years ago, “Courts cannot limit the extend, up or down, to which a man may enjoy his property; and if he goes higher than his neighbor, so long as he does not interfere with the rights of others, or injure his neighbor, he subjects himself to no liability.”

I’m not sure you can be any clearer than that.

🏆 Winner’s Circle

How did this 24-year-old walk-on linebacker go from selling shirts out of his car to becoming Nike’s biggest competitor in less than 4 years?

Kevin Plank: This is Kevin Plank, and after failing to get recruited by a single DI college out of high school, he decided to walk on to the University of Maryland, which was located less than 20 minutes from where he grew up. Now, Kevin actually carved out an impressive role for himself as captain of the special teams, but it wasn’t his athletic skill that made him stand out.

Instead, it was the fact that Kevin recalls being “the sweatiest guy on the team,” and since nearly every football player at the time would wear a cotton t-shirt underneath their pads, this often meant that Kevin had to change his shirt multiple times per game because the cotton would absorb the sweat and get too heavy.

That’s why, after graduating in 1996, he invested all of his $17,000 in savings to find a better solution, but it wasn’t as obvious as it seemed.

Kevin’s Idea: At the time, the only people wearing tight-fitting synthetic clothing were ballerinas and women in workout classes, but after testing several different fabrics in his grandma’s basement, Kevin created his very first prototype of a compression shirt made from a moisture-wicking synthetic material.

Kevin’s first Under Armour prototype

The tight-fitting shirt was meant to be worn under a player's uniform, but since the material wouldn’t absorb sweat, it would remain dry and light throughout an entire game, as compared to a traditional cotton shirt.

And with a product in hand, Kevin traveled up and down the East Coast selling these shirts from the trunk of his car; however, by the end of his first year, he only had around $100,000 in orders to show for it.

But that’s when he decided to take the biggest bet of his young career.

Going All In: In 1999, Kevin had wanted to take out an ad in one of the biggest sports publications in the country: ESPN Magazine. The only problem was that one ad cost $25,000, which was all the cash his company had on hand.

Still, Kevin and his team agreed to go without pay for a few weeks to be able to afford it, and… it worked.

By the end of that year, the company had generated $1 million in sales, fueled by both the ad and the fact that athletes genuinely loved the product because it solved a problem Kevin knew they had. After getting featured in 2000’s “Any Given Sunday,” Under Armour reached $200 million in revenue less than a decade after launching.

Under Armour in “Any Given Sunday”

By 2015, they surpassed Adidas after being valued at $20 billion, second only to Nike.

But then, that same year, it all came crashing down - let me know if you’d like to read about that in another newsletter.

⏱️ In Other News

When you refer new readers to the Bottom of the Ninth, you win exclusive prizes.

➡️ Here is your unique link to share: https://bottom-of-the-ninth.beehiiv.com/subscribe?ref=PLACEHOLDER

You’re currently at 0. That’s only 1 away from receiving a Bottom of the Ninth Sticker!

*Please do not use fake email addresses — they will not qualify as referrals. Thank you!

👋🏻 Happy Friday!

I had a realization this week: people are more likely to do something if you simply ask them.

It netted me 1,200 followers in two days on TikTok, so I don’t know why the same logic wouldn’t apply here.

So, if you’ve read this far, you’re clearly a big fan of the newsletter. Would you mind sharing this link with someone you think might also enjoy it?

https://bottom-of-the-ninth.beehiiv.com/subscribe?ref=PLACEHOLDER

Thanks in advance 🤞🏻

Reply